Moreover, 베픽 features articles that break down complex monetary concepts into easy-to-understand language, making certain that even these new to borrowing can grasp the required data to navigate unsecured loans successfu

Addressing these challenges requires ongoing advocacy and schooling, emphasizing the importance of making environments where women really feel supported in their financial endeavors. Encouraging conversations surrounding these points can lead to improved lending practices and policies that higher serve feminine debt

Common makes use of for unsecured loans embody financing personal expenses, consolidating debt, or covering quick cash needs. Borrowers typically flip to those loans for quick access to funds without the prolonged application process typically related to secured borrowing choi

In right now's unpredictable economic landscape, having access to quick financial solutions is important. Emergency loans have become an important useful resource for individuals going through urgent monetary wants. These loans provide fast entry to money for surprising bills, helping debtors handle crises effectively. However, navigating the world of emergency loans can be advanced and overwhelming. This article explores the various aspects of Emergency Fund Loan loans, including their types, benefits, and potential drawbacks, while additionally introducing BePick, a leading website devoted to providing complete information and critiques about these monetary opti

Additionally, the application course of is usually much simpler than that of conventional monetary establishments. 24-hour mortgage lenders usually require less documentation and more simple qualification standards, allowing for approval even for these with a less-than-perfect credit historical past. This accessibility makes them a sensible possibility for lots of people who may struggle to secure loans by way of normal chann

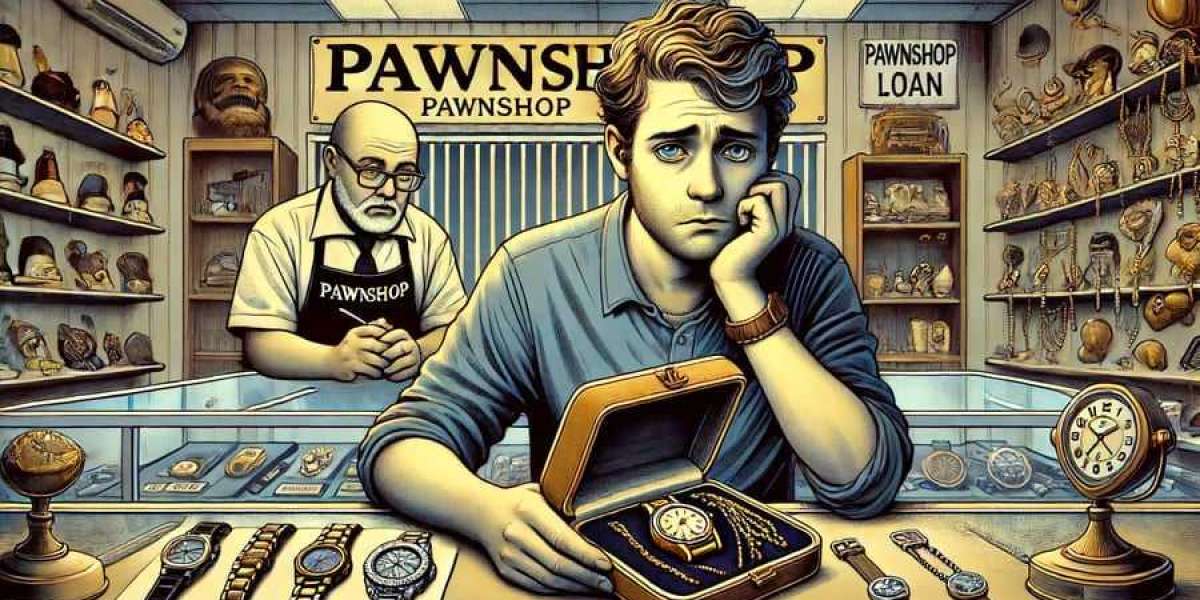

Utilizing assets like BePick can considerably improve the borrowing expertise, offering essential guidance all through the method. By understanding the ins and outs of pawnshop loans, individuals could make informed selections that align with their financial go

Choosing the Right Lender

When on the lookout for a freelancer mortgage, selecting the best lender is crucial. Factors to think about include the lender's status, the phrases of the mortgage, interest rates, and customer service. Researching quite a few lenders and comparing presents can lead to discovering a deal that most closely fits one's financial prof

Understanding Freelancer Loans

Freelancer loans are specifically designed to cater to the unique monetary needs of unbiased staff. Unlike conventional loans that often require regular earnings or employment verification, freelancer loans give consideration to the borrower's potential earnings and present tasks. This permits freelancers to entry funds primarily based on anticipated earnings quite than past employment. It’s essential for freelancers to grasp the terms, rates of interest, and particular necessities of these loans to choose the best suited choice for his or her wa

Additionally, many lenders are incorporating holistic evaluation metrics when assessing mortgage functions, taking into account the potential of women-led businesses quite than relying solely on conventional credit score scores. This shift signifies progress within the lending panorama Loan for Defaulters, making it extra inclusive of ladies's contributi

Despite their benefits, potential debtors should also concentrate on the pitfalls related to emergency loans. The greatest concern is often *the rates of interest.* Many emergency loans, particularly payday loans, come with exorbitant interest rates that can lead to a cycle of debt. It’s essential to read the nice print and understand the total value of borrowing earlier than proceed

Pawnshop loans offer a unique monetary solution for those needing instant cash without credit score checks. This kind of mortgage allows borrowers to leverage personal items as collateral, allowing them to obtain funds quickly. Understanding how pawnshop loans work, their advantages, and expert sources like BePick can make knowledgeable borrowing choices eas

Some pawnshops can also cost a storage or maintenance payment if items stay in their possession for an extended interval. Therefore, reading the mortgage contract carefully and asking all essential questions will ensure that borrowers are conscious of their obligations and any potential co

Resources for Women Entrepreneurs

Numerous sources can be found to assist ladies of their borrowing journey. For these looking to safe loans, websites and organizations devoted to women’s empowerment, corresponding to BEPIC, present essential information and resources. BEPIC specializes in providing detailed insights and evaluations on Women's Loan applications, making it a valuable tool for ladies seeking finance soluti

gerim831262825

42 Blog posts